FintechZoom Bitcoin Price Guide: Real-Time Trends Every Crypto

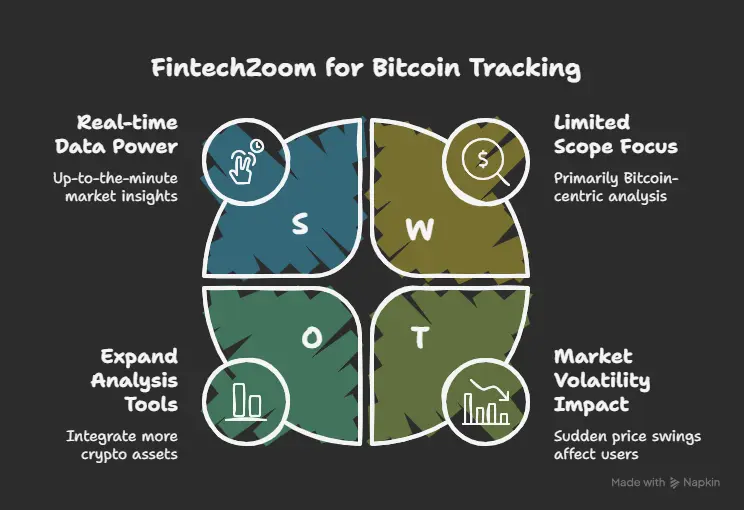

Ever feel like Bitcoin’s price chart is a wild rollercoaster? I sure did. At one point I was obsessively refreshing price charts and losing sleep over every dip. Then I discovered FintechZoom – a one-stop hub for real-time Bitcoin price tracking and analysis. It changed my crypto game. Now I can check up-to-the-minute data, set price alerts, and even dive into historical trends without feeling overwhelmed. FintechZoom provides real-time data, custom alerts, and expert insights essential for tracking Bitcoin’s movements, and I’ll share how this tool helped me stay ahead of market swings.

When I first logged into FintechZoom’s Bitcoin dashboard, I was impressed. The interface is clean and intuitive – even a beginner can find current price charts, trading volume, and volatility indicators at a glance. As someone who once struggled with noisy charts, I loved that FintechZoom continuously updates Bitcoin prices so I always see the latest market condition. In fact, I learned that this platform even has a live Twitter feed and an app for real-time tracking – a handy way to keep tabs on sudden price spikes. Pro Tip: I set a custom alert for when Bitcoin crossed certain thresholds so I never miss a major move. This saved me more than once when Bitcoin suddenly surged or dropped.

Real-Time Tracking and Alerts: Staying Ahead of the Market

When I’m scoping crypto trends, I always want the freshest data. FintechZoom delivers just that. The moment I open the Bitcoin price page, it’s like a pulse of the market – charts and numbers updating in real time. I remember one morning in late 2024 when Bitcoin was teetering around $100k; thanks to FintechZoom’s live ticker, I saw the needle jump over $108k in a blink. According to Coinbase data, Bitcoin even hit all-time highs around $108k in Dec 2024. Without real-time tools, I would have missed that thrill. FintechZoom makes it easy to follow such movements and acts quickly.

But tracking is only half the battle – alerts are the game-changer. FintechZoom’s custom price alerts let me choose any price threshold, and boom – I get a notification when Bitcoin hits it. Pro Tip: I set alerts just above and below key levels (like $100k or $90k) so I catch both breakouts and corrections. I struggled for a long time relying on my own memory or generic apps, but once I switched to FintechZoom’s alerts, I was always one step ahead. For example, when Bitcoin slipped below a target and the alert hit my phone, I was able to strategize on the fly instead of scrambling.

- Real-time data keeps my finger on the pulse.

- Custom alerts notify me of big moves instantly.

- User-friendly dashboard: Even after coffee, I can check the latest prices in seconds.

These features make FintechZoom feel like a friendly assistant. Instead of staring at charts late at night, I have it doing the heavy lifting. And since it’s not just a data feed – it also offers insights and news – I feel more informed than ever.

Analyzing Price Trends and Market Sentiment

One of my favorite parts of FintechZoom is digging into the history. Bitcoin’s price history is volatile – I once had a mini heart attack in 2017, so I always look at long-term charts now. FintechZoom lets me scroll through years of data to spot patterns. It even highlights seasonal trends, like how prices often rally after certain events. That told me, “Hey, maybe these dips are normal corrections, not time to panic.”

Sometimes the charts surprise me. Last winter, Bitcoin rocketed like a rocket launch (on FintechZoom’s chart, it literally looks that way!). I read that market sentiment was extremely bullish and adoption news was everywhere. FintechZoom aggregates social media and news sentiment so I could actually see why the price was shooting up. When the mood turns negative, it shows too. Understanding sentiment has helped me avoid chasing pumps. For instance, if Twitter and news are overly euphoric, I step back; if they’re fearful, I consider whether it’s a buying opportunity.

FintechZoom’s analytics even let me compare Bitcoin to other cryptos. I’ve correlated Bitcoin’s moves with Ethereum and smaller altcoins using their tools. This broad perspective helped me realize that crypto often moves together – when Bitcoin climbed to ~$99k in late 2024, altcoins did the same. Spotting these correlations early made me more confident in my strategy.

Here’s what worked for me: I started using FintechZoom’s historical data charts to mark important dates – like past highs, halving events, and market crashes. When similar patterns reappeared, I was ready. For example, after the 2024 halving, Bitcoin surged (just like in 2020), and I was expecting it – FintechZoom’s trend tools made that obvious.

My Personal Tips for Smart Crypto Tracking

Diving into crypto can be wild, but a few habits have kept me sane:

- Set realistic alerts. I make sure I’m not constantly pinged for tiny moves. Alerts for major levels (like round numbers or breakouts) let me relax more and focus on big opportunities.

- Mix data with instincts. While FintechZoom’s charts and predictions are great, I still do my own little research (news, friends, odd hunches). It’s like having a radar and a gut feeling together.

- Stay calm and learn from mistakes. Yes, Bitcoin’s price can swing 10% in a day (it’s happened!), but I learned to see those dips as buying chances, not catastrophes. The historical charts on FintechZoom helped me remember, “Last time it dipped, it bounced back”.

- Secure your investments. It’s not directly FintechZoom, but I always double-check any wallet or exchange safety. Knowing that FintechZoom also focuses on crypto security reminds me: protect your keys!

Pro Tip: Treat every alert as a learning moment. When FintechZoom tells me Bitcoin hit a new high (like the $108k peak), I take a moment to research news. Was it an Elon tweet? A new ETF? Understanding causes helps me predict next moves better.

Finally, always remember risk management. I jokingly tell friends, “Don’t bet the farm on one coin!” FintechZoom’s emphasis on risk tools (like stop-loss orders) is a good reminder. Even on the days my portfolio went down, knowing I had stop-losses in place (something FintechZoom suggests) kept me from panicking and made me stay invested with a clear mind.

Let’s Wrap It Up

Tracking Bitcoin price on FintechZoom has genuinely transformed how I interact with crypto markets. It feels like chatting with a well-informed friend who’s also a financial guru. I’ve gone from frantic chart-refreshing to confident trend-following, and I owe a lot of that to the platform’s real-time data, alerts, and analysis tools.

If you’re juggling the chaos of crypto prices like I once was, give FintechZoom a try. It’s helped me turn volatility into opportunity. And hey, we all started somewhere – I still remember feeling completely lost in 2017. Now, with the right tools and tips, I feel like a seasoned trader giving advice to my past self. Stay curious, stay safe, and happy trading!